Which 1099 Form Do I Use for Subcontractors

For 2020 forms filed in 2021 that appears to be. Build 1099 Tax Filing Forms With Our Platform - Export and Print Free Today.

Building Construction Contract Agreement Kerala Google Search Contractor Contract Construction Contract Independent Contractor

1099 are due to subcontractors by January 31 st or the Monday after if the 31.

. Payers use Form 1099-MISC Miscellaneous Information or Form 1099-NEC. Ad 1099-Misc Reporting More Fillable Forms Register and Subscribe Now. You use Form 1099-MISC Miscellaneous Income for payments of 600 or more to your subcontractors.

Do you pay subcontractors. If you paid anyone 600 or more you need. With 1099 contractors employers dont provide benefits cover employment taxes or pay for supplies and overhead.

A business should send you a 1099 at the end of the year if they have paid you 600 or more. Ad Get A Fillable 1099 Created By Our Tax Experts. Employers should use caution however when they classify.

How do I determine whether my worker is an employee or subcontractor. Sign Documentation The. 1099-misc for subcontractor.

Section 6041 of the Internal Revenue Code requires a business that pays more than 600 to a subconcrator to send the IRS a Form 1099-MISC reporting the amount paid. Print File Instantly- 100 Free. E-File With The IRS - Free.

Starting in 2020 the IRS now. First of all you need to use the Online Self Employed version or the Desktop Home Business program. Tax Forms Made Simple - Save Time File Instantly With The IRS - Export To PDF Word.

The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors. Have you always issued Form 1099-MISC with Box 7 nonemployee compensation filled in. Work easily and keep your data secure with 1099 subcontractor form on the web.

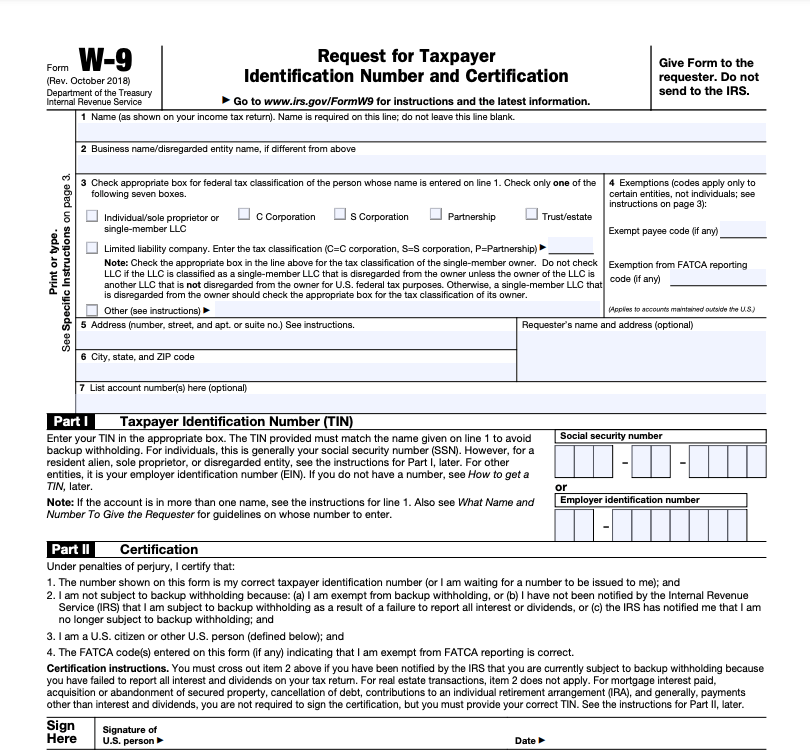

The Social Security Administration shares the information with the Internal Revenue Service. At the end of the year use Form W-9 to complete Form 1099 for each subcontractor you paid. Ad Use Step-By-Step Guide To Fill Out 1099-MISC.

PdfFiller allows users to edit sign fill and share all type of documents online. This shows the IRS the income the subcontractor received from your. The subcontractor agreement should encompass the payment structure payment terms job details inability to perform andor cancellation of the job.

Please notify the IRS when your business company or employer receives outside services from a vendor contractor or subcontractor by filing a 1099-MISC form. Download and Submit 1099 Forms. Verify or enter missing email addresses for your contractors so that we can send access to view their 1099 forms online.

The Internal Revenue Service requires businesses to send subcontractors a Form 1099-MISC for all tax years in which the business paid the subcontractor more than 600. Get the 1099 subcontractor form and fill it out with the feature-rich document editor.

Now Is The Time To Start Preparing For Vendor 1099 Forms Innovative Cpa Group

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Do You Need To File Form 1099 Nec Alfano Company Llc

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Really good information and easy to understand. Thanks for helping!!!. Get services of 1099 NEC form

ReplyDelete